Economy

England Justifies the Need for Air Tax

Advertisement

This article explores the rationale for this tax proposal, highlighting the results of recent studies that point to the relevance of methane and nitrous oxide emissions in human respiration.

The Emergence of the Air Tax Proposal

The debate over whether to introduce an air tax comes at a crucial time as the global community looks for innovative ways to tackle climate change. UK authorities are increasingly seeing the need for more comprehensive measures to reduce greenhouse gas emissions.

The study led by Dr Nicholas Cowan, an atmospheric physicist at the UK's Centre for Ecology and Hydrology in Edinburgh, shed light on the contribution of human respiration to these emissions.

Gases Present in Human Breathing and Their Impact on Total Emissions

Scientists reveal that although human breathing emits carbon dioxide (CO2), which is absorbed by plants, methane and nitrous oxide gases, present in smaller quantities, play a significant role in greenhouse gas emissions.

Methane and nitrous oxide are both potent gases, contributing to global warming, but their presence in lower concentrations may have previously been underestimated.

Study Results: A Detailed Analysis of Human Emissions

To better understand the extent of emissions from human respiration, researchers conducted a comprehensive study involving 104 adult volunteers from the UK.

Participants underwent tests in which they took a deep breath, held it for five seconds, and then exhaled into sealed plastic bags. The breath samples were analyzed for methane and nitrous oxide, revealing surprising data.

The results indicated that nitrous oxide was present in all samples, while methane was found in only 31% of the participants. Furthermore, the analysis revealed a possible correlation between the presence of methane and demographic characteristics such as age and sex.

Intriguingly, people who exhaled methane were more likely to be female and over 30 years old, although the reasons for this correlation are still unknown.

Implications and Challenges of the Air Tax Proposal

The proposed air tax raises significant questions about its feasibility and implementation. The study highlights that the contribution of CO2 from human respiration to climate change is virtually zero, due to absorption by plants.

However, methane and nitrous oxide, which are not absorbed in the same way, present distinct challenges. This point highlights the need for a differentiated approach when considering environmental and fiscal policies.

Environmental Considerations and Future Study

Experts involved in the study emphasize that their analysis focused only on greenhouse gases present in human breath, and does not offer a comprehensive view of a person's emissions footprint.

However, they suggest that further investigations into human emissions of these gases could reveal valuable insights into the impacts of population aging and changing diets.

The study highlights the need for a holistic approach when monitoring and addressing air emissions. The proposed air tax could be an initial step in finding practical solutions that balance environmental awareness with economic viability.

Rethinking the Relationship Between Human Breathing and the Environment

As society grapples with the climate crisis, the proposed air tax offers a unique opportunity to rethink our relationship with the environment. Studying emissions from human respiration is an important step toward better understanding our impact on the planet and developing sustainable strategies for the future.

In a world that is constantly evolving, environmental policies need to be as dynamic as the climate change we seek to address. The air tax debate is one piece of this larger puzzle, and its resolution will certainly shape the path we take towards a more sustainable future.

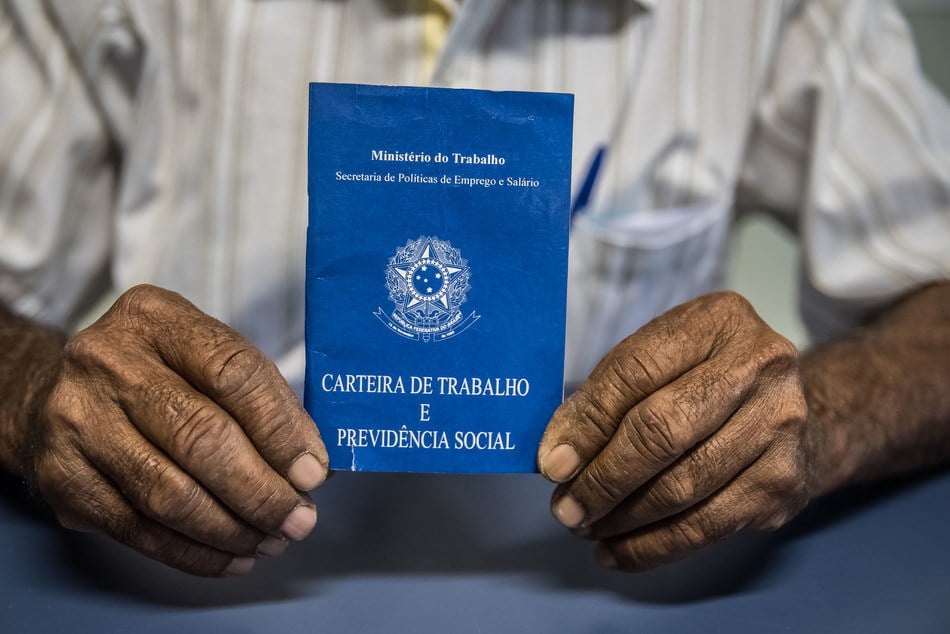

Brazil is one of the countries that pays the most taxes in the world

In Brazil, taxation is a central issue that impacts both citizens and companies. The tax burden in the country is known for being one of the highest in the world, with a complex tax structure that includes the Tax on Circulation of Goods and Services (ICMS), Tax on Industrialized Products (IPI), and Income Tax, among others.

An instrument that draws attention to this reality is the “Taxometer“, an online tool that calculates in real time the total taxes collected in the country. Developed by the Commercial Association of São Paulo (ACSP), the Taxometer aims to raise awareness among the population about the size of the taxes paid daily.

This mechanism highlights the importance of fiscal transparency and stimulates debate on the need for tax reform to simplify the system and make it more equitable. The discussion around taxes in Brazil is crucial to promoting a fairer and more efficient tax burden.

Read too: Goodbye IPVA New Rule Promises to Ease Your Pocket in 2024

You may also like

Approved Labor Reform

The Modernization of Labor Laws and the approved Labor Reform, materialized in the new rules established, completed one year.

Keep Reading